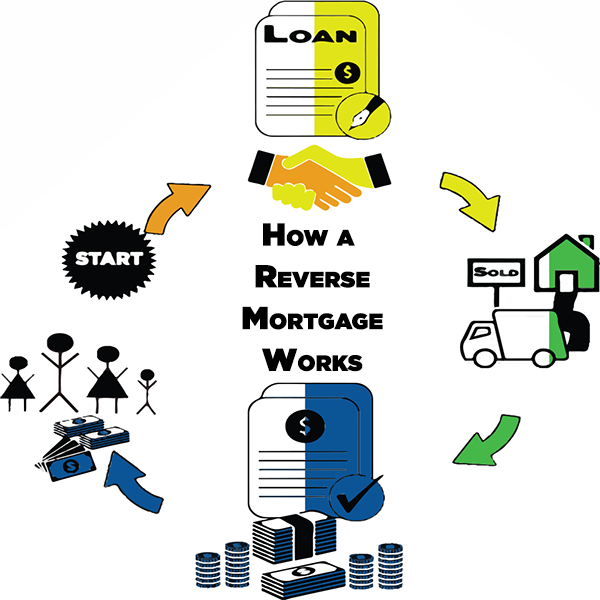

How A Reverse Mortgage Works

Sep 13, 2016 | 1 MIN READA reverse mortgage enables a home owner who is at least 62 years of age to borrow money based upon the value of his home. A reverse mortgage can provide access to the home’s equity. The home serves as the loan’s collateral. The loan gets repaid when the owner dies, moves or sells the house. To qualify for a reverse mortgage an owner must typically own the house outright or be close to owning it. The home’s value and homeowner’s age determine the size of the reverse mortgage; it cannot exceed the home’s value. The loan can be either: 1) a lump sum; 2) monthly checks; or 3) a combination of a lump sum and monthly checks.

Retirees with few other alternative options may find reverse mortgages to be a good source of additional funds. Any person interested in a reverse mortgage should carefully weight all options as less expensive options may be available.

Retirees with few other alternative options may find reverse mortgages to be a good source of additional funds. Any person interested in a reverse mortgage should carefully weight all options as less expensive options may be available.

Fees with reverse mortgages generally include high origination costs, closing fees, insurance and servicing fees. These fees are included with the loan and accrue interest. Having a reverse mortgage can make it more difficult to sell the house, move out or rent the house, or even add a name to the title. As the home’s equity is paid out, heirs will receive a smaller inheritance from the home’s diminished value.

ELCO recommends that anyone interested in a reverse mortgage should seek professional advice from a financial planner and/or a tax consultant. ELCO neither endorses nor condones reverse mortgages.

Some States specifically prohibit licensed insurance producers from participating, for a fee in the origination of any reverse mortgages.