Tax Deferral: The Power of Compound Interest | ELCO Mutual

Apr 19, 2023 | 5 MIN READ The old saying “There are two things you can’t avoid: Death and taxes” is a popular phrase for a reason. However, while the Internal Revenue Service (IRS) is often strict with taxation-related issues, there are some ways to put off taxes on your income and reduce the amount of money you owe on your yearly income.

The old saying “There are two things you can’t avoid: Death and taxes” is a popular phrase for a reason. However, while the Internal Revenue Service (IRS) is often strict with taxation-related issues, there are some ways to put off taxes on your income and reduce the amount of money you owe on your yearly income.

Leveraging retirement investments that have tax deferral baked into them is one effective means of reducing your tax burden while preparing yourself for the future. Using tax-deferred investments that feature compound interest growth can help you fund your retirement and meet your goals for your life after work.

What do tax deferral and compound interest mean? How do they affect your retirement planning? Are there any drawbacks to using a tax-deferred investment account?

What Is Tax Deferral?

Tax deferral is a popular feature available for many individual retirement accounts (IRAs) and insurance products, such as annuities. Utilizing this approach, individuals are able to postpone their tax payments. Taxation will typically occur once funds are withdrawn from the contract, allowing the owner to plan for when they’d like to pay taxes (normally when they’re in a lower tax bracket).

It’s important to note “tax deferral” means something separate from the concept of making pre-tax contributions to a fund. When you make “pre-tax” contributions, you take the money out of your income for the year before you pay taxes on it (while informing the IRS that you set aside the money in a qualified retirement fund) so your tax burden for the year is reduced. Making pre-tax contributions can help you push your income into a lower tax bracket and save some money (or earn a higher refund) when you file your taxes.

In both cases, you’re putting off paying taxes until later and alleviating your tax burden in the current year. Another benefit of deferring taxes is that, in many cases, your retirement income will be less than what you were earning during your working years. This may mean being in a lower tax bracket during retirement and paying less in taxes overall.

What Is Compound Interest?

Compound interest is a feature of many investment products where the interest you accumulate then earns additional interest—creating a pattern of geometric growth for the funds.

For example, say you have an investment worth $10,000 that earns 2% interest per year. At that growth rate, even without any additional contribution on your part, your investment would be worth $10,200 after one year—growing by $200. The next year, your investment would be worth $10,404—growing by $204. The next year, it would be worth $10,612.08—growing by $208.08.

Where did that additional yearly growth come from? From the compounded interest. This rate of growth will continue for every year the investment is allowed to sit. Of course, this oversimplified formula assumes that no taxes need to be paid on the earnings. If taxes do need to be paid on the growth, then the amount it grows by is reduced.

This is where setting up a tax-deferred income stream can help.

How Does Compound Interest Work with Tax Deferrals?

Compound interest allows accumulated interest to earn additional interest. There are a variety of products that can be used to conservatively build value. However, many require the owner to pay taxes on the earnings at the end of each year (like CDs).

This can limit the growth of the funds as opposed to an account that has a tax-deferred status which allows a contract to continuously build on the existing earnings. The difference of a few dollars may not seem like a lot at first, but it will ultimately result in a major benefit for the owner.

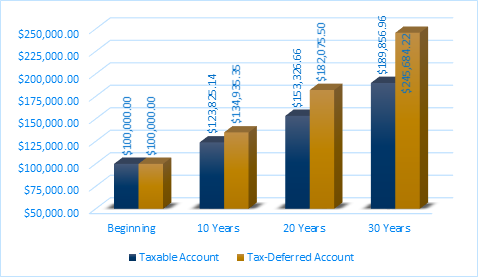

The following graphic exhibits the long-term difference between an account that is deferred and one that isn’t. If two individuals purchased two different products, worth $100,000 each and earning roughly 3% APY, the growth after 10 years would show a $10,000 plus difference. After 20 years, the gap between the two widens to almost $30,000, clearly demonstrating the true power of compound interest.

The following graphic exhibits the long-term difference between an account that is deferred and one that isn’t. If two individuals purchased two different products, worth $100,000 each and earning roughly 3% APY, the growth after 10 years would show a $10,000 plus difference. After 20 years, the gap between the two widens to almost $30,000, clearly demonstrating the true power of compound interest.

Pre-Tax Deferral vs Roth IRA Contributions

Speaking of retirement investments, what’s the difference between tax deferral and Roth IRA investments?

The short answer is that a Roth contribution is made after taxes. Because money in a Roth account has already been taxed, no taxes are owed on the contribution amount upon withdrawal. Instead, you only owe taxes on the earnings the Roth account made.

Alternatively, some Roth IRA accounts are considered tax-exempt, with no taxes owed on contributions or withdrawals. Speaking with a financial advisor to see if tax-deferred or tax-exempt retirement accounts may be best, as there are restrictions set on tax-exempt products.

What Kinds of Investments Are Tax-Deferred?

401k’s, 403b’s, deferred annuities, IRAs and Roth IRAs are all commonly recognized as tax-deferred (or, in some cases, tax-exempt) products. A deferred annuity will normally credit an interest rate that provides an attractive yield for those looking to grow their funds outside of a 401k/403b.

In contrast, 401k’s and 403b’s tend to offer higher rates of return and are funded by resources that come directly from the owner’s paycheck and/or by contributions made by the employer. Roth IRAs offer the unique ability to open a contract with post-taxed funds, while eliminating the taxation on any future earnings. Roth IRAs cannot be opened using short-term products as they must be in force for at least five years to qualify.

Do Tax-Deferred Products Have a Downside?

While useful, tax deferral still carries one major flaw with it related to the transfer of wealth. Deferred products are great for those looking to bolster and utilize their retirement funds. However, these products can become less advantageous for any beneficiaries of the contributor if they pass away before claiming the full fund.

When an individual passes away, any remaining funds will be passed on to their beneficiaries (or estate), potentially causing a taxable event. If the account is an IRA, the beneficiary will be taxed on the entirety of the contract; differing from a non-qualified contract which only taxes the earnings. There are certain ways of avoiding this drawback (ELCO’s strategy here), but generally, the beneficiary will be liable for any taxation.

So, when setting up a tax-deferred savings or investment account, you may want to consider the estate planning implications such accounts can have. Once again, consulting your financial advisor and preparing for these eventualities is a good way to help smooth the transition of your estate.

Preparing for Retirement with Tax-Deferred Income

Products with compound interest offer a financial and strategic advantage for those looking to prepare for retirement. The ability to develop a nest egg by utilizing compound interest offers an excellent avenue for building wealth.

The downside of using a tax-deferred product is the potential effect on the beneficiary after the current owner passes away. However, despite the fact that this can create a potential tax burden for the recipient, the pros outshine the cons. Building a secure nest egg for retirement is essential. By using the power of tax deferral, it has never been easier.

This article is not intended to serve as financial advice. Please consult with a financial advisor or a certified financial planner before making major decisions regarding your investments.

Was this article helpful? If so, let us know at marketing@elcomutual.com. Follow us on Facebook, Twitter and LinkedIn for any and all updates and news articles!

This article is for informational purposes only. The details and descriptions listed above are only partial, for more information please contact your local financial or tax advisor.